Although not, investors have to be mindful having playing with control, and especially people who find themselves fresh to futures exchange. The new line to the leftover shows the fresh time whenever for each bargain stems from expire, while you are information about costs (as well as rate transform) and you may quantities can be viewed. What’s more, it offered these with comfort by allowing them to help you hedge against shedding costs. Wholesalers, https://tradingmaxedge.com/ at the same time, you’ll manage themselves from rising can cost you in addition to effectively do the inventories by the trade having futures. List futures are around for the new Dow-jones Industrial Mediocre and the brand new Nasdaq a hundred, and their respective fractional well worth types, e-small Dow and age-small Nasdaq one hundred deals. Directory futures are also available to have foreign places, including the Frankfurt Replace as well as the Hang Seng Directory inside the Hong Kong.

On the other hand, a pals you are going to hedge the market to have merchandise it consume. That give predictable costs even when the cost of spray energy varies. Centered inside 1993, The newest Motley Fool is a financial characteristics company intent on to make the country wiser, delighted, and you can richer.

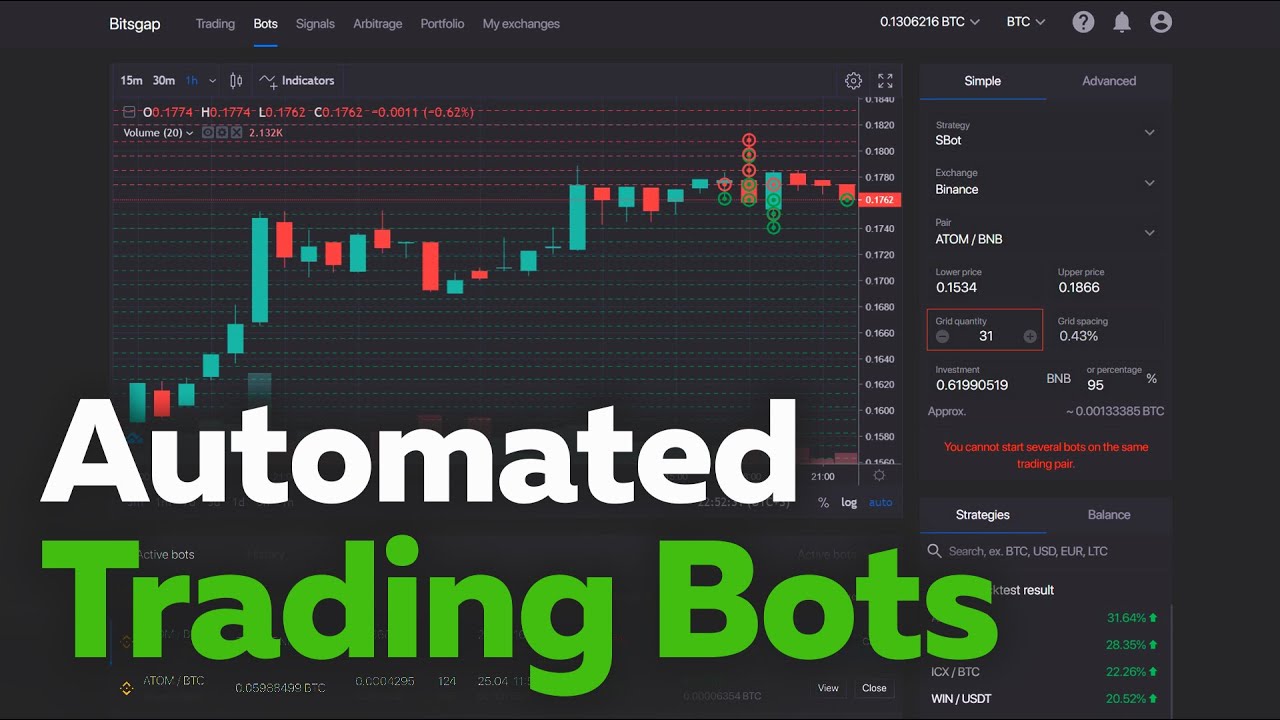

In the wide world of derivatives, buyers can obtain market “mini futures,” and this represent a portion of the root resource. Whether developing their futures change system inside-house, otherwise contracted out it, there will invariably end up being some degree of 3rd-team application integration expected. CRM, conformity, customer service, industry news, technical study, and you can business research are all types of app which is often must subcontract. The fresh move and signals their proceeded push for the derivatives trading, a location dominated from the around the world transfers such Binance and Bybit. The capacity to give perpetual futures in this You regulating architecture offers Coinbase an aggressive edge, possibly attracting people seeking a great certified program.

- Futures are contracts to find or sell a specific underlying investment during the a set coming go out.

- From the get across-referencing these types of technical signals that have macroeconomic study or market-specific reports, buyers could form a properly-told method.

- Coinbase asserted that the service would offer additional-sized contracts to have traders.

- Yet not, moreover it form you won’t reap the advantages should your rates out of corn skyrockets prior to it is time to amass.

- Futures deals is also protected current cost out of possessions from the a great repaired rates from the an appartment time later on.

The newest exchange is even working on unveiling continuous-design futures on the You.S. that have enough time-dated expirations.

Before making your first exchange, it’s essential to features an agenda which takes care of both huge visualize plus the better information—the new macro and also the micro. Once your membership is actually discover, you can find the futures deal you would like to get otherwise offer. Such, if you’d like to wager on the expense of silver climbing towards the end of the season, you could potentially find the December silver futures offer. As opposed to stock options, futures require the offer manager to settle the newest package.

Influence (playing with a little bit of money to deal with larger agreements)

In addition to, the new each day payment of futures cost raises volatility, to the investment’s really worth switching significantly from one change example to next. The customer away from an excellent futures deal has to take hands of the fundamental brings or shares during the time of expiration rather than prior to. American-style alternatives allow the owner the best, yet not the duty, to find or promote the underlying investment any moment until the termination date of the deal.

Transfers and you will business makers, such as, otherwise algorithmic and higher-regularity change (HFT) functions, features a lot less threshold to own latency and so require much more detailed tools configurations. In the past, perpetual futures trade try mostly offered to worldwide users thanks to Coinbase Worldwide Change and its offshore types platform. Considering Coinbase, types take into account 75% out of change frequency around the world, leading them to a good “cornerstone” from crypto areas. Down to one, there have been good demand of crypto-local U.S. subscribers for managed futures. Coinbase Derivatives is looking so you can discharge round-the-clock futures change of bitcoin (BTC) and ether (ETH), the new CFTC-regulated futures case of your crypto change established to the Tuesday.

Such, the original margin of 1 grain futures deal is actually $dos,five hundred, that is an important lowest to open a swap on the an excellent futures change. While the newest futures replace is one form the initial margin, the broker will need one to have more fund on your account, entitled restoration margin. Minimal count might be on your membership at any offered time, usually between 50% to help you 75% of your own initial margin.

Rating stock information, portfolio guidance, and much more on the Motley Fool’s advanced features. An in-depth glance at the best gold and silver coins ETFs on the You.S. stock exchange this year. Once you have made very first futures trade, you might clean and you may recite, develop which have higher achievement. All-content on this site is actually for educational aim simply and you will cannot constitute financial information. Consult related financial benefits on your country of residence to locate personalized suggestions prior to making any exchange otherwise paying behavior.

Although not, moreover it raises control, and this magnifies each other prospective profits and you may loss. By the seventies, futures change prolonged past commodities for the monetary devices for example stock spiders, bonds, and currencies. The fresh Chicago Mercantile Change (CME) produced the initial monetary futures package inside 1972, allowing people to take a position for the money action. A good futures market is an exchange where investors can acquire and you may offer futures deals.

Even if futures trading includes higher threats on account of influence and more difficult using and trading processes, it offers multiple upsides. Furthermore, an investor can also be choose explore spread trading ranging from two synchronised locations, while the some other needs often move in an identical advice. Including, an investor may go long S&P futures and you may small NASDAQ futures if they consider the fresh S&P is undervalued next to the NASDAQ. Futures trade constantly comes to influence plus the broker demands a primary margin, a small part of the bargain worth. The amount depends on the fresh package proportions, the fresh creditworthiness of your own investor, and also the broker’s terms and conditions.

Most investors think about to purchase a secured item wanting one their speed goes right up later on. But quick-selling lets people perform some contrary — borrow money to help you choice an enthusiastic asset’s rates tend to slide so that they can obtain after for less. Hedgers, such as manufacturers and you can users of commodities, can use futures so that you can improve cost, stabilize income or will set you back, mitigate the possibility of speed movement, and you may include predictability to their companies. Such, a character you’ll offer grain futures ahead of collect in order to secure an excellent price, when you’re a meal manufacturer might purchase grain futures so you can lock in brutal topic will cost you.

If they trust the purchase price usually fall, they might play with futures to protected the brand new sales speed to own commodities that they have to stop incurring a loss in the event the rates drops. Futures can be used from the traders to speculate in regards to the advice of one’s business and also to hedge facing loss. Futures is contracts made ranging from a couple parties obligating these to transact a secured asset during the a given rates from the specific predetermined future day. DNB supervises the fresh conformity from eToro (Europe) Ltd on the Anti-Currency Laundering and Anti-Violent Investment Act and also the Sanctions Act 1977. The new crypto services out of eToro (Europe) Ltd commonly at the mercy of prudential oversight by DNB otherwise conduct oversight by AFM.