You have made 40 100 percent free revolves for one dollar and also you’ll along with take pleasure in a one hundred% matches bonus to $two hundred. The newest brokerage firm went along to your local sheriff’s workplace to help you document a violent complaint up against Spadoni. Spadoni try detained on the 7 April to own theft higher than $twenty-five,100, financial ripoff and you may unlawful sign from economic financing, the fresh sheriff’s workplace announced. Spadoni is from a good $150,one hundred thousand thread, according to the Ny Times, and it has been recently discharged out of her work as the a dispatcher. Under the consent decree the lending company wanted to create an excellent $700,one hundred thousand money to pay subjects and take many other restorative tips. For the August 18, 2020, the usa recorded a complaint inside the Us v. Dad & Son Swinging & Shops (D. Bulk.).

The fresh consent order necessitates the defendants to invest $dos.0 million to the subjects from discrimination and has inside the put financing prices formula, overseeing and you may staff knowledge one to be sure discrimination will not take place in the long term. To the December 1, 1994, the us attained an enthusiastic agreement for the defendants, resolving allegations the owner and you can property owner of a condo strengthening inside Chicago, Illinois got violated the new Fair Housing Act because of the sexually bothering females clients. The brand new consent decree expected the master and property owner to expend $180,100000 inside financial save, so you can avoid dealing with otherwise entering the apartment building, and build a great trust work to market the structure. For the January 11, 2011, the brand new judge inserted a agree order in All of us v. Millikin Univ. (C.D. Ill.), a good Property Act election recommendation of HUD. The ailment, recorded to your November six, 2009, so-called one Millikin School inside Decatur, Illinois discriminated on the basis of disability when they necessary a student who has an excellent seizure illness which is legally blind so you can import to some other dormitory when she obtained her solution animal. The fresh concur order necessitates the school to teach its personnel from the regulations from realistic rentals also to shell out $cuatro,436.89 for the former college student.

- To the August, twelve, 2005, the newest legal registered the fresh agree decree resolving You v. Hurley (Age.D. Tenn.), a reasonable Property Act election case which was regarded the new Section by the Company from Housing and you may Urban Development (HUD).

- The united states subsequent argued one HUD’s structure of your FHA observe directly from the language, construction, and records the newest FHA.

- The problem, which was submitted for the December 23, 2013, so-called a pattern otherwise practice of discrimination based on race and you can national supply inside the home-based mortgage financing.

- The brand new decree necessitates the percentage away from $5,000 on the family, checklist staying and you will reasonable property training.

- The newest concur buy includes financial rescue of $53 million with a municipal punishment of $55,100000.

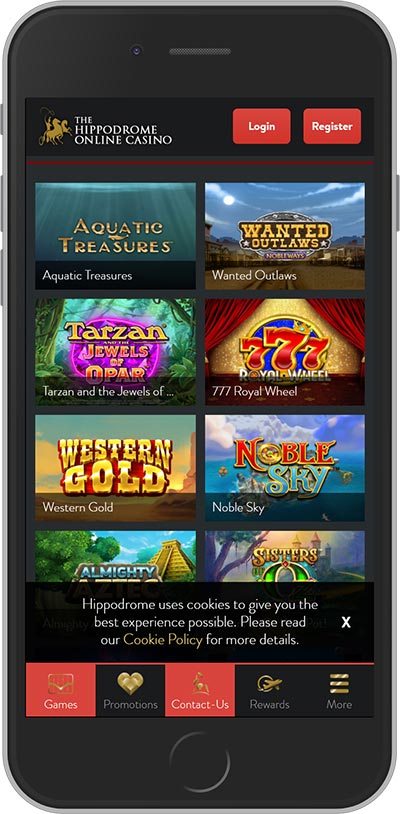

Zorro real money $1 deposit: Gate777 Casino – A good Acceptance B…

The newest Civil-rights Office, the united states Attorneys to the Eastern Area of the latest York, the fresh Company of Homes and Urban Invention, as well as the Federal Trade Payment advertised one Delta Investment Firm broken one another zorro real money $1 deposit reasonable lending and you can user protection laws. Delta are involved with subprime mortgage lending and gets much of their finance thanks to mortgage brokers. While the company operates in more than simply a third of the says, its company is focused inside the Brooklyn and you can Queens, Nyc, mostly inside the fraction domestic portion. The united states was able to look after the brand new fit which have a payment agreement, and this relates to the business’s procedures nationwide. The newest agreement demands Delta, among other things, to won’t financing finance which have discriminatory otherwise unearned agent fees and also to guarantee you to fund commonly made to people just who cannot afford the newest payments. Economic save as high as $twelve million might possibly be paid so you can sufferers lower than a past arrangement ranging from Delta, the newest York State Financial Agency, and the Ny Condition Attorney General.

Specifically, the newest defendants had and you will worked out an insurance policy from refusing to lease second-floor systems to families which have students and you can disappointing family members that have students away from renting from the state-of-the-art. Under the contract the brand new defendants pays up to $115,000 to pay victims of discrimination in the Pecan Terrace Rentals, and spend $29,000 in the municipal punishment to your All of us. The brand new payment in addition to requires numerous corrective actions, along with education to the standards out of federal houses law, a nondiscrimination rules, listing staying and you may monitoring. Evidence for this case was developed from Division’s Fair Housing Analysis System. To the November 14, 2001, the new legal entered a good agree decree in Us v. Mills d/b/an excellent Chestnut Features (D.N.H.), a pattern or pratice/election suggestion from HUD. The criticism, which was submitted to your June 7, 2000, up against the resident and previous local rental movie director away from an apartment cutting-edge inside Manchester, The newest Hampshire, alleged that the defendants broken the fresh Fair Property Operate centered intercourse.

Offering the fresh Claim to your Offender

To your October 2, 2007, the newest legal registered a good consent decree resolving Us v. City of Chapel Slope, Vermont (Yards.D.N.C.). The problem, that has been filed to your December 12, 2005, so-called the town broken the newest federal Fair Homes Act when it would not grant a citizen of Chapel Slope a hotels on her behalf disabled child. The new citizen, up coming a citizen away from personal houses, got repeatedly questioned a reasonable hotel in the form of a great transfer to a wheelchair-obtainable equipment. The town operates the new Church Mountain Company away from Housing, and this takes care of 336 personal homes systems web sites inside Chapel Mountain.

For the February 8, 2016, the fresh court registered the newest agree purchase in You v. Rappuhn (Letter.D. Ala.), a structure & structure lawsuit between your access to terms of the Fair Housing Act and you can Us citizens having Handicaps Operate. The ailment, which was filed on the Sep 30, 2015, so-called one Allan Rappuhn and his awesome connected organizations have been working in the proper execution and you can construction from 71 multifamily homes developments which have around cuatro,090 total products and you will dos,717 FHA-shielded devices based in Alabama (36 features), Georgia (25), North carolina (nine), and Tennessee (one). Of one’s 71 functions, 69 was based playing with both Low-Earnings Housing Income tax Loans (“LIHTC”) and/or funds from the home Connection Funding Program (“Family financing”). On the Sep 14, 2000, the brand new court joined a consent buy resolving Us v. Prestonwood Characteristics (N.D. Tex.), a good Housing Operate development otherwise practice/election recommendation of HUD.

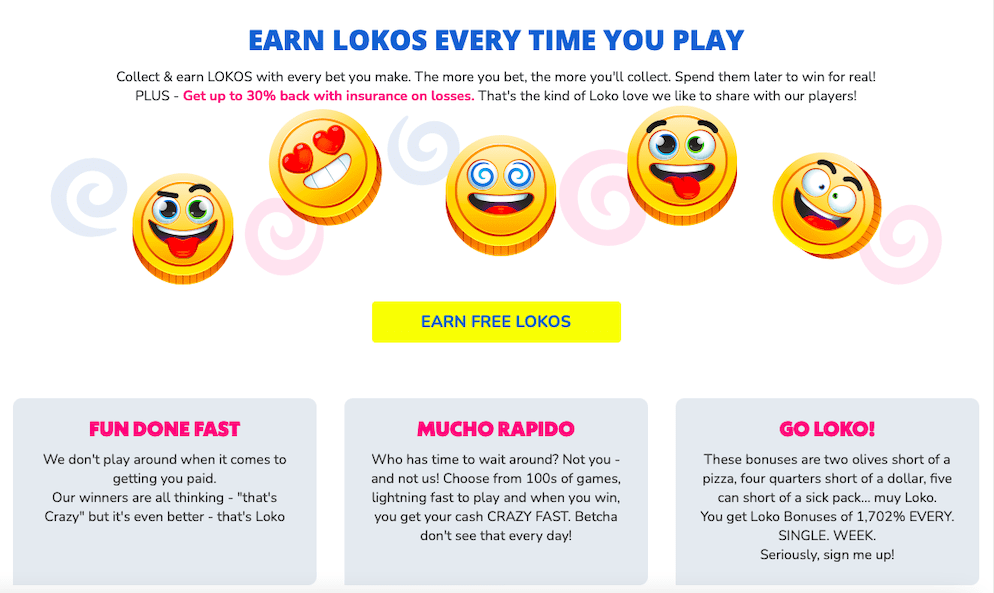

Betway Casino – Added bonus Small print

There are also the individuals harbors which feature no traces at all, additionally known as Reactor or Team Pays harbors. Of a lot casino players usually open up a slot machine, to alter their limits and begin spinning. Very few people replace the quantity of lines they explore, as well as in of several progressive harbors, the number of contours readily available can’t be modified at all. These may help you build-up a strong bankroll one which just tackle the newest video game by themselves. Bonuses are great, however, sort through the newest wagering conditions to understand exactly how many series you might have to spin the brand new harbors to transform wins to your withdrawable dollars.

The newest “agree buy out of initial injunction” involving the Us and also the defendant brings the defendant and you may any entities associated with the new defendant invest in design and make all of the coming protected multifamily dwellings inside conformity to the Reasonable Property Work. For a passing fancy go out, the courtroom in addition to offered the us’ action so you can amend the case caption, replacing the modern offender “Webster AV Government, LLC” because the titled offender. The problem, that has been recorded on the December 23, 2016 by Us Lawyer’s Office to the Southern area District of the latest York, alleges that the offender broken the new Fair Homes Act from the faltering to develop and build features in the Bronx and you may Maybrook thus which they have been available and you can available from the people that have handicaps.

To the August 8, 2002, the new court entered an excellent concur buy resolving All of us v. Wingo (C.D. Cal). The newest complaint, in the first place registered inside the December, 2000, and amended to your April 10, 2001, alleged the owners and you may executives away from two apartment complexes engaged inside a routine otherwise practice of discrimination on the basis of competition, federal origin, by intimately harassing the girls tenants. To the December 15, 2000, the fresh Section submitted an excellent actions in order to intervene and you can a quick inside intervention to guard the new constitutionality of the Reasonable Houses Act. The brand new defendant had submitted a motion to help you write off arguing that the Reasonable Homes Operate are unconstitutional insofar since it outlaws racial and you will sexual harassment inside leasing segments.

The new problem resulted of an advice by Agency away from Housing and Urban Invention (HUD) as a result of its research out of administrative complaints submitted by Reasonable Homes Investment of the Courtroom Support People of Albuquerque, Inc. (“FHP”) and you will a woman having a couple of minor people. The newest administrative complaints had been recorded that have HUD just after research held by the fresh FHP showed that defendants had stated choices so you can book in order to family members rather than students and you can cited large local rental cost to families that have pupils. For the July 10, 2008, the new court registered a consent decree in You v. Midtown Innovation, LLC (S.D. Miss.).

To the December 9, 2010, the usa filed complaint and concur acquisition resolving United states v. PrimeLending (N.D. Tex.), a reasonable lending trend or practice instance. PrimeLending’s plan out of giving the team wide discretion to boost the commissions by the addition of “overages” in order to money, and this increased the eye cost paid off by consumers, got a different affect African-American borrowers. The brand new defendant, a nationwide home loan company with 168 workplaces within the 32 states turned into one of the country’s 20 prominent FHA lenders from the 2009. PrimeLending didn’t have monitoring set up in order that it complied on the fair credit laws and regulations, even while they increased to help you originate over $5.5 billion inside fund a-year.